Advanced gold project with 9km strike covered by 65,000 metres of historical drilling.

The Labola Project is located in the far southwest of Burkina Faso within the Birimian age Banfora Greenstone Belt. While there are no active large scale gold mines within this belt in Burkina Faso, the 3.8Moz Yaoure gold deposit is located within extensions of this belt approximately 450km to the south in Ivory Coast. The 4.5Moz Banfora gold mine, recently renamed Wahgnion and owned by Teranga Gold, is located about 80km to the southwest in an adjacent belt.

Figure 1: Geological map of Kurkina Faso

Historical Activity

The area has been the site of intense artisanal gold mining activity since around 2004. As much of the easily mineable near surface material has now been mined out, many of the miners have now left. The mining has been largely within weathered primary material (quartz veins within metasediments) although some alluvial gold has been won from the downstream parts of drainages that cut across the mineralisation.

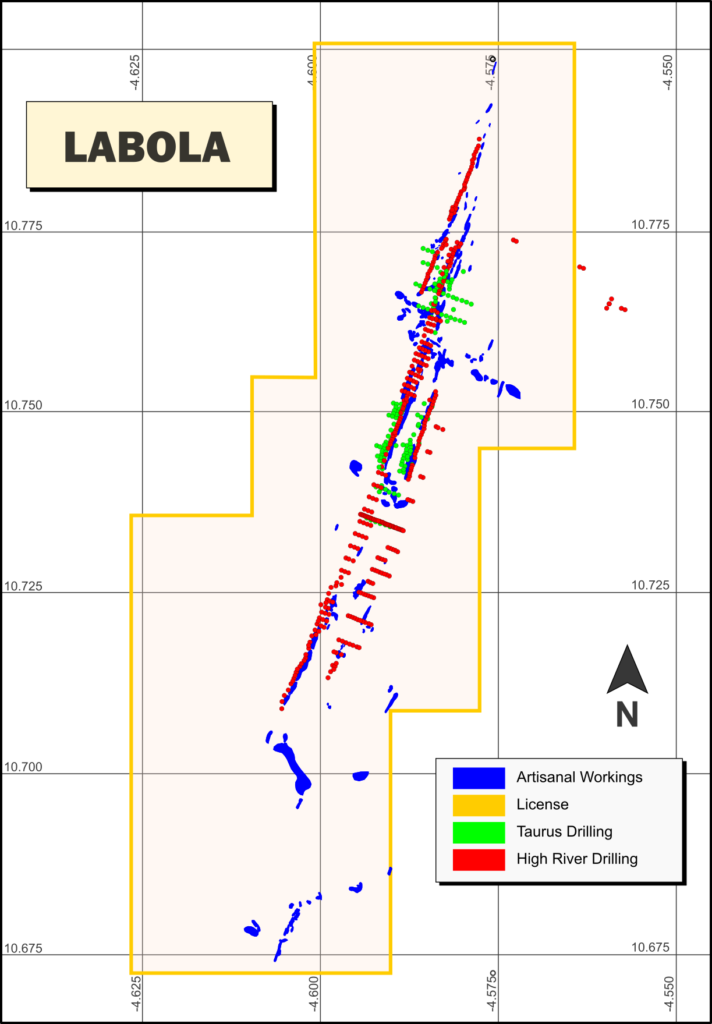

The area has previously been extensively drilled by two companies, Taurus Gold and High River Gold, who each held separate parts of the area with some overlap. All up, over 65,000m drilling has been conducted on the project as shown on the table and image below. The areas of artisanal mining sub-parallel to the three main zones suggest significant additional exploration potential exists outside these zones and not covered by previous drilling.

Moydow has successfully obtained the historical data and combined this into a single database for the first time. This historical data, together with the completion of a 4,740 metre RC drilling programme in 2021 culminated in the announcement of a maiden resource estimate in 2021.

Geology

The artisanal workings appear to have focussed on either a single quartz vein, sheeted quartz veins or stockwork quartz veins. A similar style of mineralisation is interpreted from the drilling data, where either single high grade quartz veins or wider zones of sheeted to stockwork quartz veining are interpreted. Some strong sulphide alteration (mainly arsenopyrite and pyrite) is noted in dump material from the artisanal mining and in the drill core surrounding quartz veins. This also appears to host gold mineralisation.

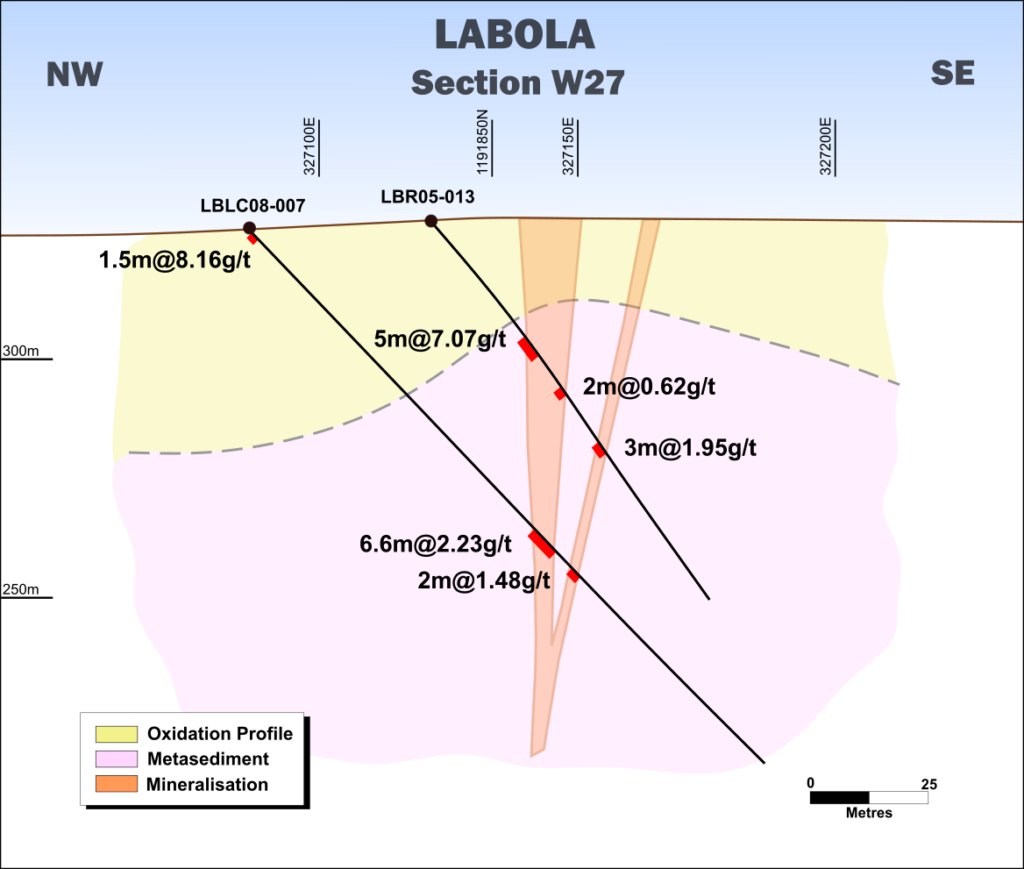

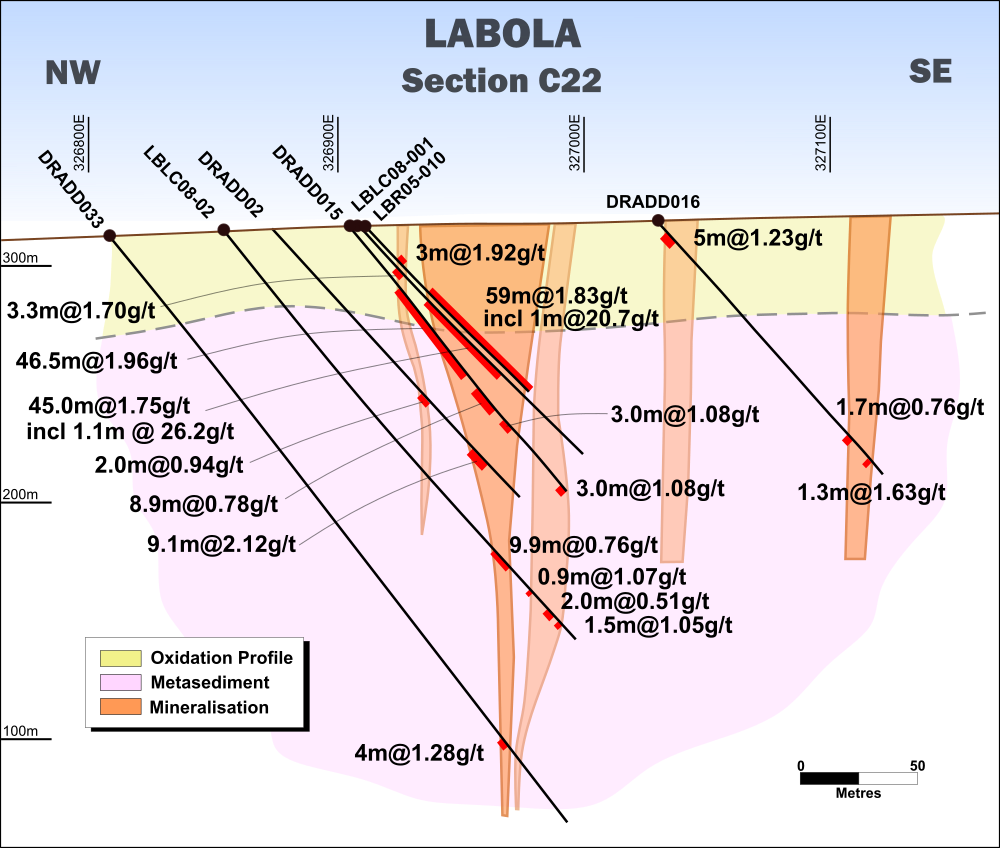

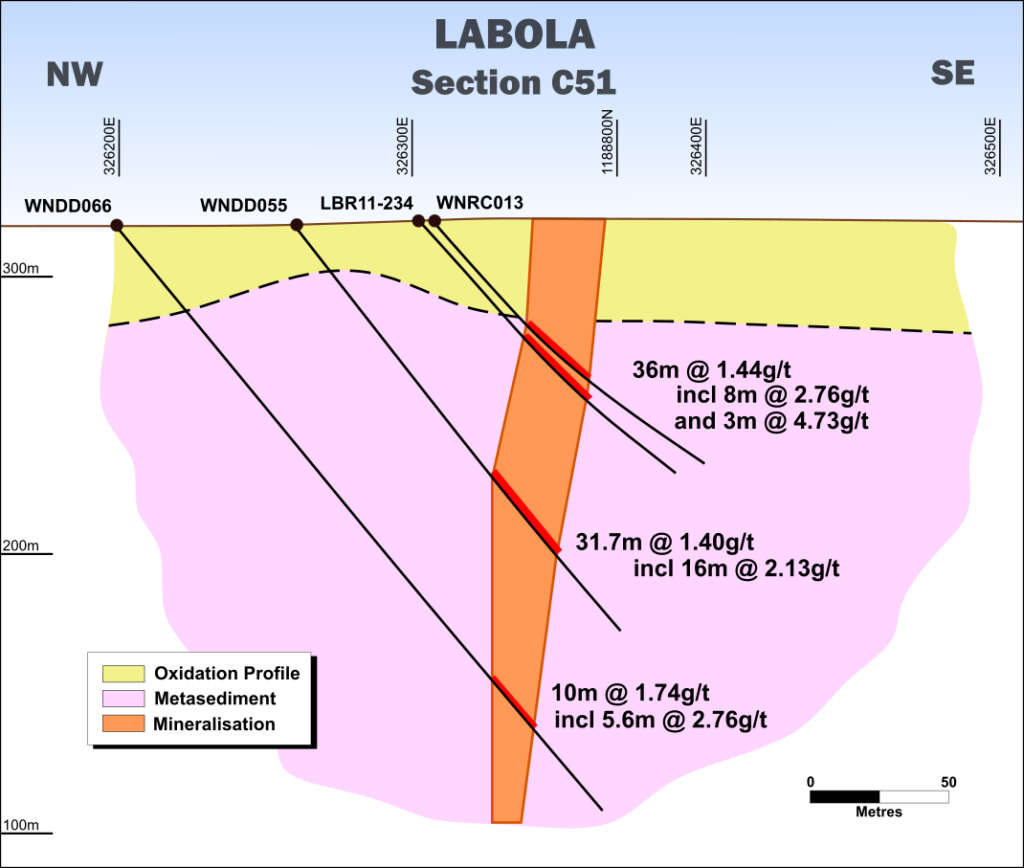

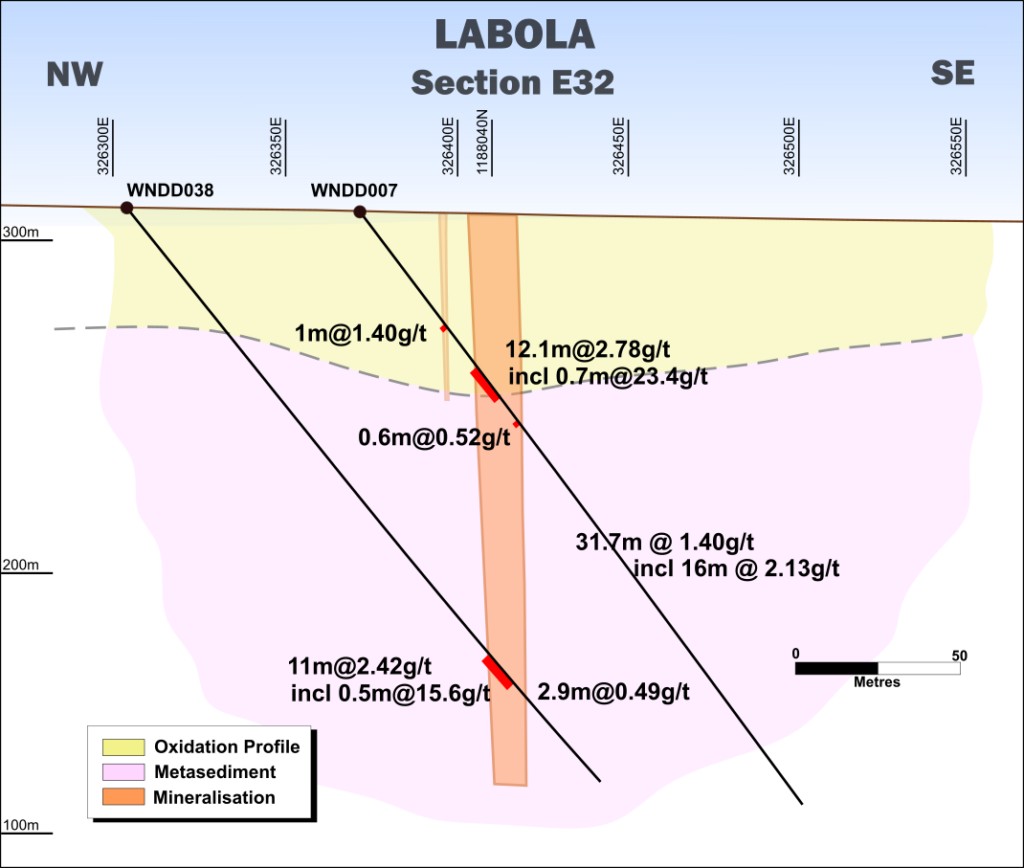

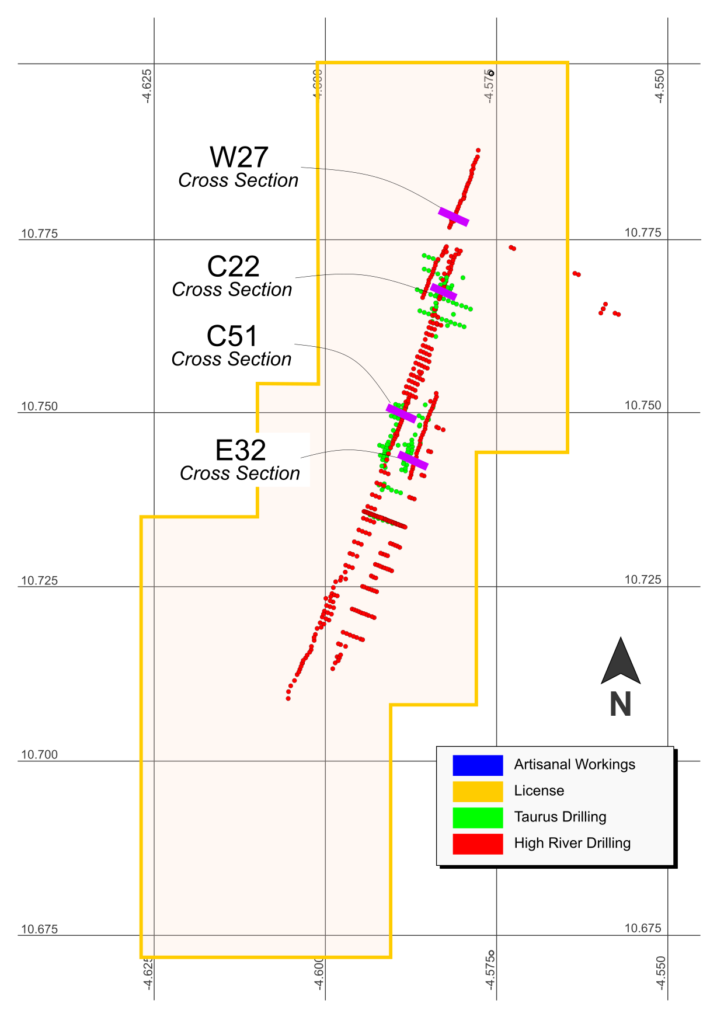

Cross Sections

While some areas appear to be relatively barren, this may be partly due to the drilling density. The four cross sections below show the style of mineralisation encountered in mineralised pods in each of these zones.

Ownership Structure

The Labola project is owned and managed by Moydow Holdings Limited. In mid-2022, Panthera’s interest in Moydow was restructured and Company completed a farm-in agreement with Diamond Fields Resouces Inc (DFR). Following completion of the restructure:

- DFR has agreed to spend up to US$18 million (Earn-In) on Labola and increase its ownership interest up to 80%;

- upon completion of the Earn-In, Panthera holds the right to increase its interest by 10%, for example, from 20% to 30%, for a cash cost of US$7.2 million; and

- DFR is the operator of Moydow.

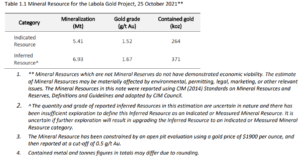

On 25 October 2021 and 6 December 2021, Moydow issued a maiden mineral resource estimate in accordance with National Instrument 43-101 (“NI 43-101”) for the Labola Gold Project in Burkina Faso (“Labola” or the “Project”). The report was prepared by Ivor Jones, an independent qualified person under NI 43 101, for Aurum Consulting.

Moydow has estimated the amount of the resource that has been depleted by artisanal mining to be approximately 341,000 tonnes at 3 g/t Au. The quantity of mined material has been calculated from estimates of dump and leach pad volumes. The grade of the material mined has been estimated in the range of 1.5-3.0 g/t Au and is based on an evaluation of extensive rock chip, channel sampling of artisanal workings and selective sampling of adjacent dumps. The location of where the material has been mined from is not known with any degree of accuracy. As such, artisanal mining has not been deducted from the Mineral Resource but noted here for reference.

The mineral resource estimate (MRE) for the Labola Project has been prepared by Mr Ivor W.O. Jones, M.Sc., FAusIMM, P.Geo, of Aurum Consulting, who is an independent Qualified Person (QP) under NI 43-101 guidelines and directly undertook the preparation and estimation of the maiden mineral resource estimate. Mr Jones has over 35 years of relevant experience in geology, exploration, mining, resource evaluation and management including operational and consulting experience in both open pit and underground mines. He was previously a Group General Manager for Snowden Mining Industry Consultants where he was responsible for the company’s geoscience activities globally.

Current Drilling Programme (2Q 2022)

On 26 May 2022, the Company announced that the Reverse Circulation (RC) drill rig has arrived on-site at the Labola Project in Burkina Faso.:

5000 metre RC drill programme has commenced at the Labola Project:

- The programme comprises 46 RC holes to test up to five targets

- Drilling will focus on resource estimate expansion and several peripheral exploration targets

- Assay results are expected during quarter three of 2022

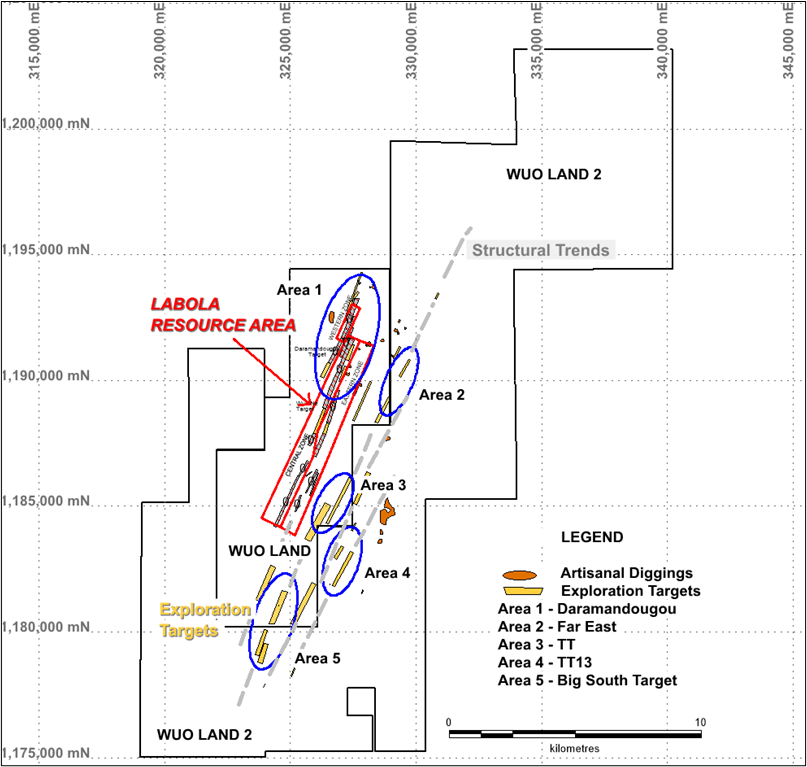

The drill programme is designed to support an expansion of the maiden resource estimate announced in 2021. The drilling will also test several peripheral targets which could demonstrate the larger-scale potential of the Labola Project.

The proposed resource estimate expansion drilling programme comprises 2000m of infill and step-out holes targeting the Daramandougou area and is included in Area 1. The modelling of the orebody in 2021 highlighted several mineralised zones where insufficient drill density may have resulted in breaks in the continuity of the resulting block model and ultimately gaps in the pit shells generated. It also showed up several of zones that might have been truncated by the model because of a lack of drilling along mineralised trends.

The 3,200 metre exploration drilling proposal will test additional pit expansion targets in Area 1 and a number of new targets within the Wuo Land 1 and Wuo Land 2 licences in Areas 1 to 5.

Burkina Faso at a glance

Main economic sectors:

Cotton lint, beverages, agricultural processing, soap, cigarettes, textiles, gold